Unlocking the Potential of Peer-to-Peer Lending: A Beginner’s Guide

By Larue Deckow

April 26, 2023

Blockchain technology has revolutionized the financial industry, giving rise to decentralized finance (DeFi) systems that have already amassed over $200 billion in value as of 2022. With the global blockchain market projected to grow to $163.83 billion by 2029, DeFi platforms are transforming the way we approach lending and borrowing.

Decentralized Finance vs. Traditional Services

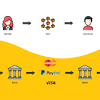

The key difference between DeFi and traditional financial services lies in the decentralized nature of DeFi, which eliminates the need for intermediaries. Peer-to-peer (P2P) financial transactions have been around since before the evolution of banking and rely on trust between transacting parties. Blockchain technology addresses issues with lending by providing a tamper-proof, virtual, global network and “smart contracts” that can automate actions based on contract metrics. DeFi apps leverage these features to enable financial transactions in a new and innovative way.

Introducing LEND Protocol: A DeFi Multi-Chain Lending Platform

This beginner’s guide introduces LEND Protocol, a DeFi multi-chain lending platform that allows users to deposit crypto assets to earn high interest or use their assets as collateral to borrow tokens. LEND aims to create a fully inclusive decentralized financial ecosystem with zero barriers to entry, offering features such as lending, borrowing, governance, earning 25% of platform revenue with $LEND tokens, and launching on multiple chains.

How LEND Protocol Works: Lending Pools and Floating Interest Rates

LEND Protocol establishes lending pools from deposited crypto assets and utilizes a floating interest rate model based on supply and demand. Users receive tokenized versions of their deposited assets, which can be exchanged for the original assets plus interest. $LEND tokens are offered as an incentive reward to users, further encouraging participation in the platform.

Unlocking the Future of Peer-to-Peer Lending with DeFi

As DeFi platforms like LEND Protocol continue to gain traction, the potential for peer-to-peer lending to transform the financial industry becomes increasingly apparent. By leveraging blockchain technology and smart contracts, these platforms offer a more inclusive, decentralized, and efficient way to conduct financial transactions. With the rapid growth of the blockchain market and the increasing popularity of DeFi, the future of peer-to-peer lending looks promising.

Like what you’re reading?

Subscribe to our top stories

By entering your email and clicking Sign Up, you're agreeing to let us send you customised marketing messages about us and our advertising partners. You are also agreeing to our Privacy Policy.