Smart Budgeting for Newlyweds: Navigating Finances Together for a Secure Future

By Terry Goldner

April 26, 2023

As newlyweds, you’re embarking on a new journey together, full of love, happiness, and shared experiences. One of the most important aspects of this journey is managing your finances together, ensuring a secure future for both of you. In this guide, we will explore smart budgeting strategies for newlyweds to help you navigate your financial life together.

Creating a Joint Budget

One of the first steps in managing your finances as a couple is creating a joint budget. This involves combining your incomes, listing your monthly expenses, and setting financial goals together. By doing this, you can gain a clear understanding of your financial situation and make informed decisions about your spending and saving habits. It’s essential to be open and honest with each other about your financial history and current debts, as this will help you create a realistic budget that works for both of you.

Setting Financial Goals

As a couple, it’s important to discuss and set financial goals together. These can include short-term goals, such as saving for a vacation or paying off a credit card, and long-term goals, such as buying a house or planning for retirement. By setting goals together, you can ensure that you’re both on the same page and working towards a shared vision of your future. Make sure to review and adjust your goals regularly, as your financial situation and priorities may change over time.

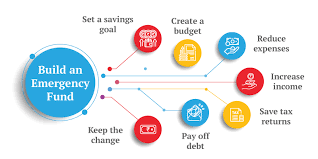

Establishing an Emergency Fund

Life can be unpredictable, and unexpected expenses can arise at any time. To protect yourselves from financial stress, it’s crucial to establish an emergency fund as a safety net. Experts recommend having at least three to six months’ worth of living expenses saved in an easily accessible account. This will give you peace of mind and help you avoid going into debt when faced with unforeseen expenses, such as medical bills, car repairs, or job loss.

Managing Debt and Credit

Debt and credit management is a vital aspect of smart budgeting for newlyweds. If either of you has outstanding debts, such as student loans or credit card balances, it’s essential to develop a plan to pay them off as quickly as possible. This may involve consolidating your debts, negotiating lower interest rates, or creating a debt repayment plan. Additionally, it’s important to monitor your credit scores and work together to improve them, as this will impact your ability to secure loans and favorable interest rates in the future.

Communication and Teamwork

Finally, the key to successfully navigating your finances as a couple is open communication and teamwork. Regularly discuss your financial situation, goals, and any concerns you may have. Be supportive and understanding of each other’s financial habits and work together to make adjustments as needed. By working together and maintaining open lines of communication, you can build a strong financial foundation for your future together.

Like what you’re reading?

Subscribe to our top stories

By entering your email and clicking Sign Up, you're agreeing to let us send you customised marketing messages about us and our advertising partners. You are also agreeing to our Privacy Policy.