Navigating the World of Peer-to-Peer Lending: A Beginner’s Guide

By Hunter Abbott

April 26, 2023

Peer-to-peer lending has emerged as a popular alternative to traditional banking and investment options. This innovative financial model connects borrowers and lenders directly, bypassing the need for banks and other financial institutions. In this beginner’s guide, we will explore the world of peer-to-peer lending and provide insights on how to navigate this exciting investment opportunity.

Understanding Peer-to-Peer Lending

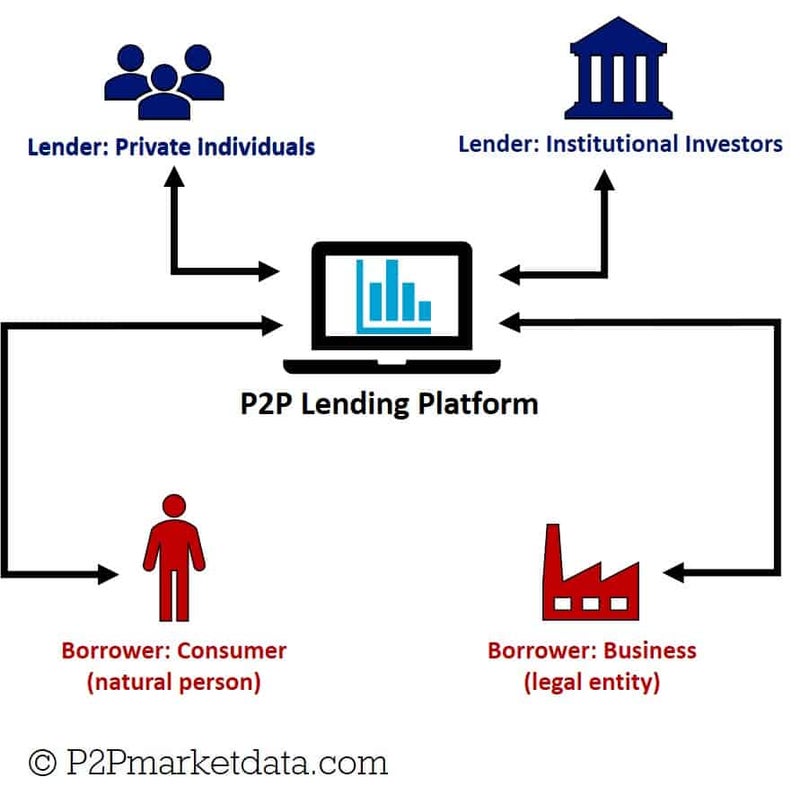

Peer-to-peer lending, also known as P2P lending or crowdlending, is a form of online lending where individuals or businesses can borrow money from multiple investors who pool their funds together. This process is facilitated by online platforms that connect borrowers with lenders, assess credit risk, and manage loan repayments. P2P lending offers benefits for both borrowers and lenders, such as lower interest rates, higher returns, and a more streamlined application process.

Choosing the Right P2P Lending Platform

There are numerous P2P lending platforms available, each with its own unique features and benefits. When choosing a platform, consider factors such as the platform’s reputation, loan offerings, interest rates, fees, and the level of customer support provided. It’s also essential to research the platform’s regulatory compliance and security measures to ensure your investments are protected. Some popular P2P lending platforms include LendingClub, Prosper, and Funding Circle.

Diversifying Your P2P Investment Portfolio

As with any investment, diversification is crucial in P2P lending. By spreading your investments across multiple loans and borrowers, you can reduce the risk of default and increase the chances of earning consistent returns. Consider investing in loans with varying risk levels, loan terms, and industries to create a well-balanced portfolio. Some P2P lending platforms offer automated investment tools that can help you diversify your portfolio based on your risk tolerance and investment goals.

Managing Risks in P2P Lending

While P2P lending can offer attractive returns, it also comes with inherent risks. One of the primary risks is borrower default, which can result in a loss of your invested capital. To mitigate this risk, carefully review the borrower’s credit history, financial stability, and the platform’s underwriting standards before investing. Additionally, be prepared for the possibility of lower returns due to economic downturns or changes in interest rates. By staying informed and maintaining a diversified portfolio, you can better navigate the world of P2P lending and make more informed investment decisions.

Like what you’re reading?

Subscribe to our top stories

By entering your email and clicking Sign Up, you're agreeing to let us send you customised marketing messages about us and our advertising partners. You are also agreeing to our Privacy Policy.